- 0086(21)62671680

- 62671061

- sales@hyssgroup.com

- Language

In the previous parts of this series, we discussed steel plays’ performance in 2014. We also saw why steel plays had a roller-coaster ride on Wall Street. As the new year begins, let’s analyze the US steel industry’s major opportunities and threats in 2015.

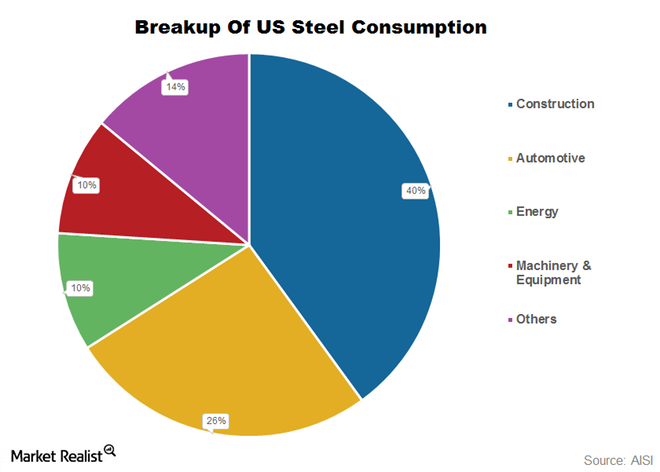

In 2015, steel plays’ major opportunity would be key end consumers’ steel demand. The construction, automobile, and energy industries are steel’s key end consumers. Together, these three industries account for more than 75% of the steel consumption in the US. This can be seen in the above chart. In the next parts of this series, we’ll analyze the outlook for these industries in more detail.

Please be aware that AK Steel (AKS) and ArcelorMittal (MT) are major suppliers to automotive companies. Nucor (NUE) is the largest supplier to the non-residential construction industry. U.S. Steel Corp. (X) is the biggest supplier to energy companies in North America. The SPDR S&P Metal and Mining ETF (XME) seeks to build a diversified portfolio of these companies.

The US steel industry faces several threats in 2015. The threats range from a macroeconomic slowdown to elevated import levels. There are also several key events that steel play investors should watch closely in 2015. We’ll discuss steel plays’ threats later in this series.

First, we’ll analyze the construction industry’s outlook. This sector accounts for 40% of total steel consumption in the US.