- 0086(21)62671680

- 62671061

- sales@hyssgroup.com

- Language

Chinese steel demand growth is slowing down. This is partly due to high inventories throughout the supply chain but also a decrease in government investment. Despite this, output in th e first four months of 2014 increased by 2.7 percent compared with the same period last year. By historic standards, this is a modest rate of growth.

e first four months of 2014 increased by 2.7 percent compared with the same period last year. By historic standards, this is a modest rate of growth.

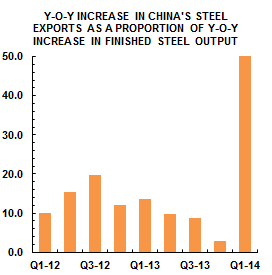

However, it is worth noting that approximately 50 percent of China’s increased, year-on-year, steel production in the first quarter of 2014 was exported. Moreover, imports of steel into China in the first quarter of this year are little changed from the figure in 2013.

MEPS states that this is bad news for steelmakers in the rest of the world. In the first three months of 2014, Chinese exports have increased by 22 percent, year-on-year. In the medium term, this will put negative price and supply pressures on domestic steelmakers in most other regions.

According to the latest data available, total exports of finished steel products by Chinese mills increased from 15.4 million tonnes in the first quarter of 2013 to 18.8 million tonnes in the same period of 2014 – a rise of 3.4 million tonnes. In the January to March period of 2014, output of finished steel totalled 192.3 million tonnes compared with 185.5 million tonnes in the equivalent time span in 2013 – a gain of 6.8 million tonnes.

China’s exports of finished steel products, in the first quarter of this year, were close to ten percent of the total output – the highest ever recorded. This level of export activity is likely to spark a new set of anti-dumping cases in the second half of 2014.